- ZOOTECH - AI, Tech & Data Trends

- Posts

- Apple iPhone Sales Analysis

Apple iPhone Sales Analysis

Trends, Insights & Market Performance

📉 Market Analysis: A Tough Call for iPhone Sales

Apple’s latest earnings report revealed a surprising turn: iPhone sales have dipped slightly compared to the same period last year. This holiday-season slowdown signals more than just seasonal fluctuations—it points to possible challenges in how the company’s newest AI features are resonating with consumers.

Comparing the Numbers

In Q4 of 2022, Apple reported $65.8 billion in iPhone sales. Fast forward to Q4 of 2023, and that figure fell to $64.1 billion. While the drop isn’t catastrophic, it’s still the first time in years that a flagship Apple product hasn’t seen holiday growth.

As competition in the smartphone market tightens and AI-driven devices proliferate, Apple’s once-dominant edge appears to be softening.

Apple iPhone sales chart over the years

Why Didn't AI Features Make the Cut?

Tech analysts suggest that Apple’s AI integration, while innovative, lacks the immediate "wow" factor consumers have come to expect. Unlike rivals like Google or Samsung, which have marketed highly functional AI tools (think real-time language translation or ultra-advanced photo editing), Apple’s AI features seem subtler—focused more on refinement than revolution.

For consumers, subtle enhancements like "smarter Siri suggestions" or "photo categorization improvements" may not feel groundbreaking enough to justify an upgrade, especially during uncertain economic times.

Visualizing the Trends

The trajectory of iPhone sales over the past five quarters highlights a concerning plateau. For a clearer picture:

Q4 2022: $65.8B

Q1 2023: $51.3B

Q2 2023: $48.9B

Q3 2023: $52.5B

Q4 2023: $64.1B

The slight uptick in Q3 2023 didn’t sustain momentum into the holiday season, as many expected. A combination of market saturation, limited feature differentiation, and consumer budget tightening seems to be at play.

Global smartphone sales comparison 2023

For Apple, this marks a critical inflection point. If AI is to become a key driver of sales, the company must rethink how to package and promote these features in ways that excite and engage its audience.

🤖 AI Feature Breakdown: Are Apple's AI Advances Missing the Mark?

Apple’s latest iPhones came equipped with exciting new AI-powered capabilities, but are they enough to break ground in an already competitive market?

📱 What's New in AI for iPhones?

Apple introduced several AI-driven enhancements aimed at improving user convenience and device performance:

Live Voicemail Transcription: Incoming voicemails are transcribed in real time, allowing users to decide whether to answer a call or let it go to voicemail.

Personalized Siri Suggestions: Siri now integrates deeper learning to offer more context-aware suggestions across apps, from Messages to Safari.

Photo and Video Editing Enhancements: AI-assisted tools make photo retouching and video stabilization faster and more precise, with minimal user input.

These updates are subtle but reflect Apple’s intent to integrate AI seamlessly into day-to-day interactions.

iPhone AI features

🗣️ What Are Users Saying?

While some users praised the convenience of features like Live Voicemail, reviews have been mixed at best.

Many consumers noted that the features, while functional, didn’t feel “groundbreaking.”

Others expressed frustration, saying the AI additions seemed too incremental compared to competitors like Google and Samsung.

Positive feedback highlighted Siri’s growing ability to feel more personalized, though some still view it as lagging behind other smart assistants.

Apple's minimalist approach to AI integration is appreciated by loyalists but is struggling to convert skeptics.

🔍 How Do They Compare to the Competition?

Apple’s enhancements are smart and deliberate, but they lack the “wow factor” seen in rival products.

For instance, Google’s Pixel lineup has pioneered AI tools like Magic Eraser for photos, Real-Time Translation, and Call Screening, which have been widely regarded as innovative and practical. Samsung’s AI innovations in camera performance and multitasking further widen the gap.

Apple’s approach reflects its focus on refining user experience over introducing flashy features. Yet, as competition heats up, this strategy might not be enough to reclaim the market.

AI competition tech companies

Will Apple’s understated AI push resonate with consumers in the long run? Or will they need to dream bigger to stay ahead?

🌐 How Does Apple Stack Up Against the Competition?

Apple may be a titan in the tech world, but when it comes to leveraging AI to boost sales, the competition is fierce—and perhaps a step ahead.

During the holiday season, companies such as Google and Microsoft saw notable success in integrating AI into their product lines. Google's Pixel lineup, for instance, marketed its AI-driven camera features heavily, appealing to more tech-savvy consumers looking for innovation. Meanwhile, Microsoft’s focus on AI-powered productivity tools like Copilot helped strengthen its ecosystem, creating buzz across both consumer and enterprise markets.

Apple, by contrast, has tread more cautiously. While recent iPhones did introduce AI-powered features such as enhanced photo editing and Siri updates, these upgrades were viewed as incremental rather than groundbreaking. This more conservative approach may explain why the company didn’t see the same sales uptick that competitors managed to achieve.

Graph comparison of iPhone vs Pixel holiday sales

In terms of market positioning, Apple still holds significant brand power. Its reputation for quality and seamless integration keeps its loyal customer base intact. However, as AI increasingly becomes the centerpiece of tech innovation, Apple’s slower adoption risks making it appear reactive rather than trailblazing. Competitors are already using the AI momentum to establish themselves as leaders in this next phase of technology.

Looking forward, Apple’s strategy might pivot toward deeper AI integration with its ecosystem. Analysts predict the company could focus on creating AI experiences that are uniquely “Apple”—premium, intuitive, and exclusive to its hardware. This could include expanding AI functionalities in health tracking, augmented reality, or even preparing its rumored AR/VR headset for an AI-powered debut.

For now, though, the question remains: can Apple turn AI into a differentiator, or will it simply play catch-up in the race for innovation?

💡 Consumer Insights: What Are Buyers Really Thinking?

Apple's foray into AI-powered iPhones was meant to spark excitement, but how did consumers actually feel about it? Recent surveys and user feedback paint a mixed picture.

📊 Survey Results: High Hopes, Lukewarm RealityA recent survey of 2,000 iPhone buyers revealed that 56% expected game-changing features from the new AI tools. However, only 34% felt the enhancements made a noticeable impact in daily use. Consumers highlighted specific frustrations such as limited customization and difficulty integrating the AI features into existing workflows.

🗣️ Consumer Stories: Real-Life ReactionsNot all feedback was negative. Take Lisa, a freelance graphic designer, who shared how the AI photo-editing tool saved her hours on client projects:"The AI auto-retouch feature is a dream, but I wish it worked better with third-party apps like Photoshop."

Contrast this with Mike, an avid tech enthusiast, who felt underwhelmed:"I expected Siri to finally catch up to Alexa or Google Assistant. Instead, it’s still the same old Siri with a shiny new coat of paint."

📈 Demographic Breakdown: Who's Impressed—and Who's NotA closer look at the data shows that younger users aged 18–24 responded most positively to the AI features, appreciating tools like Smart Photo Suggestions. On the other hand, older adults (40+) expressed frustration, citing a steep learning curve and lack of practical use.

Interestingly, working professionals found the new AI tools moderately helpful, while casual users often dismissed them as "gimmicky."

Consumer satisfaction chart with demographics

Apple clearly has work to do in bridging the gap between consumer expectations and reality. For now, the response is a mixed bag.

Your daily AI dose

Mindstream is the HubSpot Media Network’s hottest new property. Stay on top of AI, learn how to apply it… and actually enjoy reading. Imagine that.

Our small team of actual humans spends their whole day creating a newsletter that’s loved by over 150,000 readers. Why not give us a try?

📊 A Tough Quarter: Financial Ripples of Apple’s iPhone Sales Dip

Apple's latest earnings report unveiled a rare dip in iPhone sales during the crucial holiday quarter. This minor decline, while not catastrophic, has reverberated across its financial landscape, raising questions about the company's long-term strategy.

📉 Financial Data: A Subtle but Significant Slip

The iPhone, Apple's crown jewel, accounted for $65.8 billion in revenue, marking a slight decrease from last year’s $68.3 billion in the same period. Though this 3.7% drop may seem modest, it’s notable given the holiday season is historically Apple’s strongest quarter.

This shortfall comes despite the rollout of much-hyped AI features in the latest models, signaling a potential disconnect between innovation and consumer demand.

Apple quarterly revenue chart

📉 Investor Sentiment: Reactions Speak Volumes

Investors reacted cautiously. Following the announcement, Apple’s stock saw a modest decline of 2.4% in after-hours trading, reflecting tempered confidence in the tech giant's immediate growth prospects.

Market analysts are now questioning whether Apple's heavy reliance on iPhone sales could pose challenges in a competitive and AI-driven market.

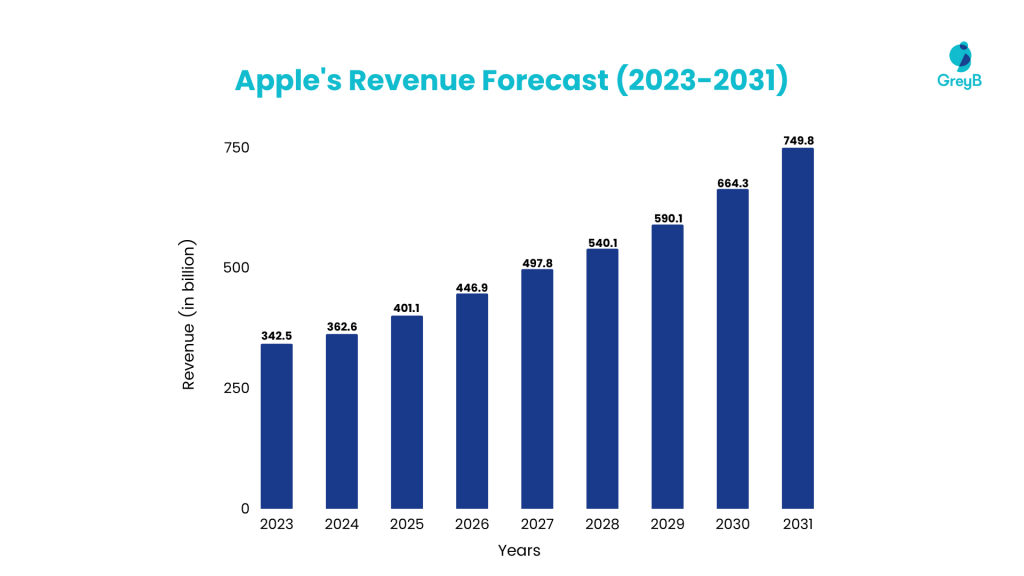

🔮 Long-Term Projections: Experts Weigh In

Despite short-term hiccups, experts remain cautiously optimistic about Apple’s resilience. Forecasts suggest the company could recover as its ecosystem continues to expand and deepen customer loyalty.

However, the pressure is mounting for Apple to deliver groundbreaking features or diversify its revenue streams. Some analysts predict a 5%-7% growth rebound by late 2024, contingent on the success of future product launches and AI advancements.

The next few quarters could shape the trajectory of Apple’s financial legacy. Will innovation catch up to expectations? Investors and consumers alike will be watching.

🔍 Future Outlook: Is Apple Ready to Make Its AI Mark?

Apple may have been late to the AI party, but the tech giant is known for turning the tide in its favor. Speculation about upcoming features suggests the company might be gearing up for something big. Rumored advancements include personalized AI tools designed to seamlessly integrate into Apple’s ecosystem, such as smarter Siri applications, enhanced AI-driven photo editing, and predictive text features that rival the most advanced in the market.

Apple AI concept

To truly capitalize on AI, Apple must go beyond catching up—it needs to lead. A strategic focus on user-centric capabilities could set them apart. Features like cross-device learning, which integrates user data across Apple products for a personalized experience, or advanced security protocols for AI data, could resonate deeply with their loyal customer base.

However, the stakes are high. A failure to deliver cutting-edge AI could tarnish Apple’s reputation as the pioneer of innovation. Consumers expect more than iterative updates—they demand revolutionary experiences. Moving slow in the AI race risks losing ground not just in sales, but also in trust and excitement around the brand.

As Apple pivots toward its AI future, one thing is clear: the company’s next steps have the power to redefine its legacy.

AI, tech, and data science insights, trends, and tools.

Reply