- ZOOTECH - AI, Tech & Data Trends

- Posts

- Tech Stock Volatility

Tech Stock Volatility

Tech stocks are all over the place.

📉 How DeepSeek AI Sparked a $1.2 Trillion Market Shake-Up

The unveiling of DeepSeek's latest AI model has done more than capture headlines—it’s sent shockwaves through global tech markets. Investors, already wary of inflated valuations, reacted swiftly, slashing $1.2 trillion from the market value of some of the largest U.S. and European tech companies.

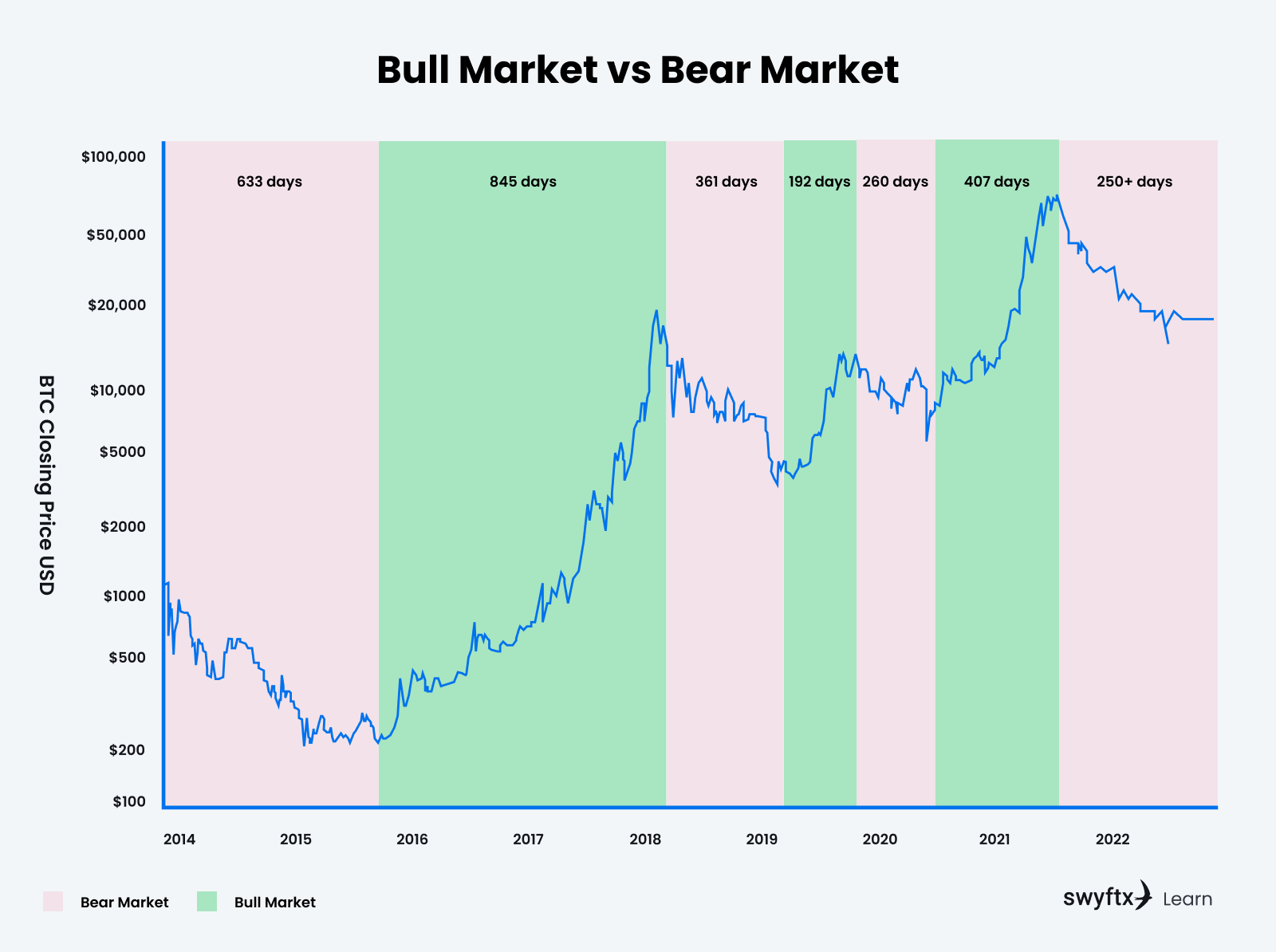

Why such an extreme reaction? Analysts point to two main factors: valuation skepticism and technological disruption. DeepSeek’s AI model is seen as a potential game-changer, and with game-changing innovation often comes uncertainty. Investors are questioning whether today’s tech giants can maintain their dominance in an environment primed for rapid AI-driven shifts.

Stock market decline chart

The fallout has been striking. Before the announcement, tech stocks were riding high, with major players like Apple, Microsoft, and Nvidia boasting record valuations. Post-announcement, these same companies saw declines ranging from 3% to 8%, wiping out billions in market value overnight. Even smaller, niche AI firms weren’t spared as investors adopted a "sell first, reassess later" mentality.

What’s next? Experts are split. Some argue this correction was overdue, describing it as a “healthy recalibration” that brings valuations in line with reality. Others warn of a potential domino effect, as tech companies scramble to address the competitive threat posed by DeepSeek's cutting-edge AI.

One thing is certain: the stakes have never been higher, and the tech sector must now navigate a landscape that has been fundamentally altered by one bold move.

🌐 How DeepSeek's AI Is Redefining Global Tech Valuations

The financial world was jolted when DeepSeek, a Chinese artificial intelligence startup, launched its latest AI model. This groundbreaking innovation sent shockwaves through global markets, triggering a $1.2 trillion drop in US and European tech stocks. But why such an extreme reaction?

Investors now face a pressing question: Are tech valuations inflated in the age of artificial intelligence?

DeepSeek’s advancements have forced many to reevaluate the worth of long-standing tech giants. With cutting-edge AI models being developed at a rapid pace, the dominance of established players like Microsoft and Alphabet suddenly seems less invincible. In essence, the rise of startups like DeepSeek signals a potential redistribution of innovation power—and, in turn, market value—across the tech landscape.

global tech stocks market valuation trend

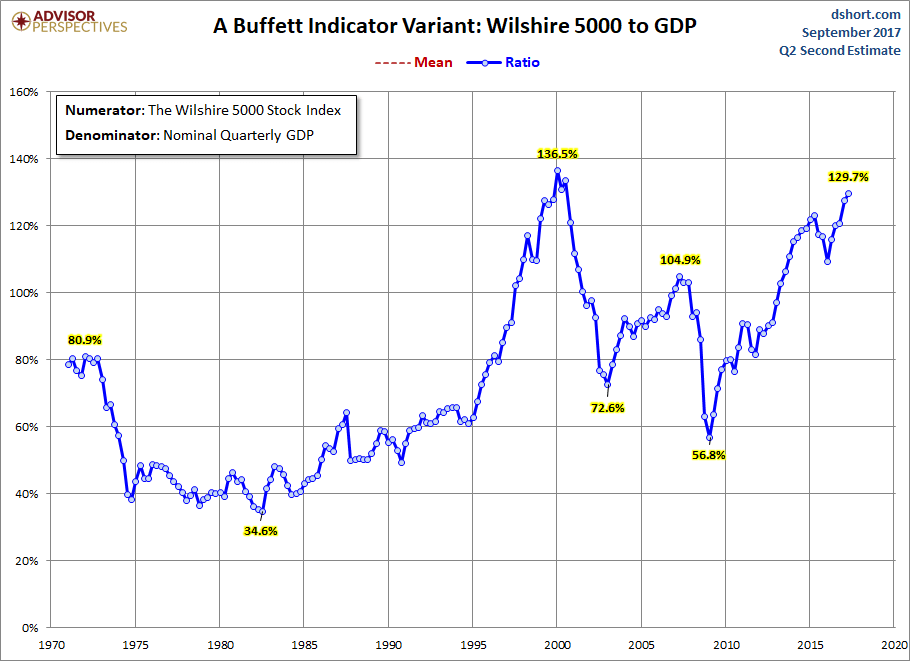

Lessons From the Past

This isn’t the first time a disruptive AI innovation has rocked the financial world. Consider OpenAI’s GPT launch, which drew billions in funding and saw AI-focused companies like Nvidia surge to unprecedented heights. But history also offers cautionary tales. The dot-com bubble, for instance, taught us that hype alone can’t sustain overvalued companies for long.

DeepSeek’s model could either elevate the valuation of promising challengers or further expose weaknesses in tech companies that are over-reliant on past successes.

What Lies Ahead

In the long term, expect global investments in AI to grow exponentially, but with a sharper focus on tangible value creation. Investors may pivot toward companies with proven AI applications rather than speculative capabilities. Moreover, emerging markets, especially in Asia, are likely to attract significant capital as startups like DeepSeek demonstrate their ability to compete on a global stage.

The result? A more diversified tech ecosystem—but one that demands careful, informed investments.

AI innovation impacting global tech investments

🇨🇳 DeepSeek: The AI Pioneer Reshaping Global Markets

DeepSeek, a rising star in China’s artificial intelligence sphere, is making waves far beyond its borders. Founded with a vision to redefine AI capabilities, this startup has rapidly climbed the ranks, challenging industry titans. Its latest revolutionary model has sparked a global conversation – and, in some cases, a market upheaval.

From its humble beginnings in Shanghai to becoming a tech phenomenon, DeepSeek stands as a testament to China’s increasing dominance in AI innovation. By combining cutting-edge research with ambitious execution, the company has attracted the attention of investors, competitors, and regulators alike.

DeepSeek AI research lab

But DeepSeek’s influence goes far beyond its home turf. Chinese advancements in AI tech, like those pioneered by DeepSeek, are now setting benchmarks across Western markets. U.S. and European firms are watching closely — not only to keep up but to adapt to a shifting balance of power in the global tech landscape.

Partnerships with Silicon Valley startups and European research institutions have allowed DeepSeek to expand its reach. Meanwhile, it faces stiff competition from Western heavyweights like OpenAI and Google DeepMind, as well as homegrown rivals like Alibaba's DAMO Academy. The race to dominate artificial intelligence has never been more intense.

What sets DeepSeek apart? Its ability to bridge the gap between East and West, blending technological innovation with global ambition. Whether this marks a turning point in AI leadership remains to be seen, but one thing is certain: DeepSeek’s journey is just getting started.

💬 Investor Sentiments: Voices from the Market

When a $1.2 trillion tech selloff ripples through US and European markets, investors don’t stay silent. The debut of DeepSeek’s groundbreaking AI model didn’t just spark financial chaos—it ignited a whirlwind of opinions, debates, and cautious recalibrations.

A Chorus of Reactions

Venture capitalists are calling it a wake-up call. Many highlight the market's over-reliance on inflated tech valuations, with one prominent VC tweeting, “Finally, we’re seeing reality check the AI bubble.” Meanwhile, retail investors are split. Some see this as the perfect time to “buy the dip,” while others are pulling back, spooked by the volatility.

Institutional investors, however, are taking a measured approach. A portfolio manager at a leading hedge fund remarked, “This isn’t panic. It’s a correction. The long-term AI story is still intact, but valuations need a reset.”

Investor sentiment analysis graph

The reaction online has been as intense as the selloff itself. Sentiment analysis across Twitter, Reddit, and LinkedIn reveals a stark divide:

About 40% of posts express optimism, with users speculating that the selloff creates room for stronger growth.

30% express caution, calling for more transparency from AI companies like DeepSeek.

The remaining 30% display outright pessimism, with hashtags like #TechTrouble trending globally.

Prominent financial blogs, including TechValuations Daily and AI Horizons, have released detailed breakdowns of the selloff’s implications. Many stress that this isn’t the end of AI innovation—it’s the beginning of more realistic expectations for the sector.

Strategic Adjustments: What’s Next?

Investors are recalibrating their strategies. Hedge funds are hedging further, diversifying portfolios to include more energy and healthcare stocks. Retail investors are leaning on dollar-cost averaging, buying small increments of tech stocks to ride out the uncertainty.

Meanwhile, private equity firms are eyeing undervalued AI startups, betting on a rebound once the dust settles. As one insider editorial put it, “This disruption is a storm. But for prepared investors, it’s also a rare opportunity.”

Stock market chaos and investor meeting

This is just the beginning of the conversation—and the strategy shifts. How will the market adapt as DeepSeek and other AI players continue to disrupt the landscape? Only time will tell.

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

🔍 Future of AI: Beyond the Hype

As the dust settles from DeepSeek’s market-shaking AI announcement, one question looms large: What’s next for artificial intelligence?

DeepSeek’s latest model isn’t just a technological feat—it could redefine entire industries. From precision-driven healthcare to real-time financial forecasting, the potential applications are staggering. Imagine AI systems diagnosing diseases with near-perfect accuracy or predicting economic trends faster than ever before. These are no longer futuristic dreams; they’re fast becoming today’s reality.

AI technology applications in various industries

But with transformative power comes enormous responsibility. Integrating advanced AI like DeepSeek’s into everyday business practices raises significant challenges. System bias, data privacy concerns, and the risk of over-reliance on automation are just the tip of the ethical iceberg. Companies must tread carefully to balance innovation with accountability, ensuring AI works for humanity—not against it.

Looking ahead, AI’s evolution shows no signs of slowing down. Experts predict an acceleration in autonomous systems, from AI-powered supply chains to adaptive learning platforms in education. As global markets adapt to these advancements, entirely new industries could emerge while existing ones face disruption.

The future of AI isn’t just about technology—it’s a reshaping of how the world works.

AI, tech, and data science insights, trends, and tools.

Reply